dallas county texas sales tax rate

The Texas sales tax rate is currently 625. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

How To Charge Your Customers The Correct Sales Tax Rates

Tax Office Past Tax Rates.

. The Dallas County Tax Office is committed to providing excellent customer service. AddisonDallas Co 2057217 010000 082500. There is no applicable county tax.

Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit. 625 percent of sales price minus any trade-in allowance. TEXAS SALES AND USE TAX RATES July 2022.

214 653-7811 Fax. Groceries prescription drugs and non-prescription drugs are exempt from the Texas. It is the second.

There is no applicable county tax. 34 rows The local sales tax rate in Dallas County is 0 and the maximum rate including Texas. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. As of the 2010 census the population was 2368139. A full list of these can be found below.

Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must. TX Sales Tax Rate. The average cumulative sales tax rate between all of them is 825.

3 rows Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas. 214 653-7811 Fax. Dallas County is a county located in the US.

Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100. The sales tax rate.

4 rows Dallas. Contact each city directly for property zoning information and lien releases for tax foreclosed properties. This is the total of state county and city sales tax rates.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive. Records Building 500 Elm Street Suite 1200 Dallas TX 75202. The minimum combined 2022 sales tax rate for Dallas Texas is 825.

Contact the Customer Care Center at 214-653-7811 Monday through Friday from 800 am. The most populous location in Dallas County Texas is Dallas. The current total local sales tax rate in Dallas TX is.

214 653-7811 Fax.

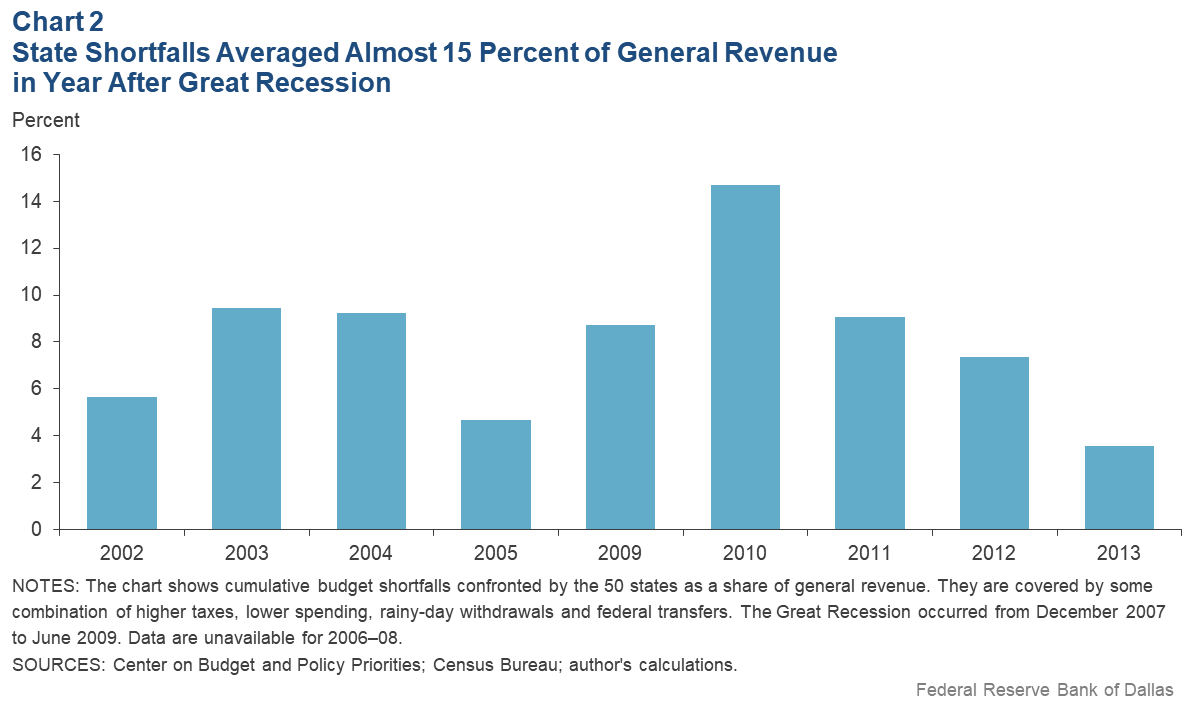

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

How To Charge Your Customers The Correct Sales Tax Rates

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Tax Rates City Of Richardson Economic Development Department

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Texas Sales Tax Rates By City County 2022

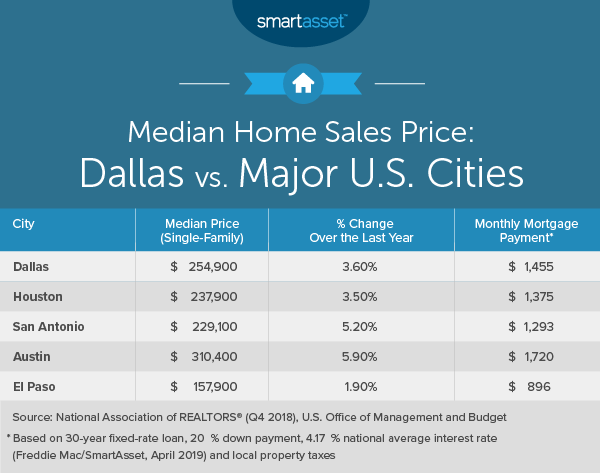

Cost Of Living In Dallas Smartasset

Texas Sales Tax Guide For Businesses

2021 2022 Tax Information Euless Tx

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Why Are Texas Property Taxes So High Home Tax Solutions

How To Charge Your Customers The Correct Sales Tax Rates

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price